Industry: Consumer Electronics (High-Ticket 3C Products)

Amazon Marketplace: United States

Implementation Period: May 2025 - December 2025 (9 months)

Customer Profile: Established seller with mature ad account, annual revenue >$1M

Executive Summary

A premium consumer electronics seller with an already-optimized Amazon advertising account leveraged DeepBI's AI advertising platform to push performance beyond human-managed limits. Despite starting with an industry-leading 14.72% ACOS, the seller achieved:

- Drove ACOS from 14% → 3%: Starting from an already optimized 14.72% ACOS, DeepBI consistently outperformed existing optimization levels, sustaining 3–5% ACOS and uncovering margin that was previously thought to be fully captured.

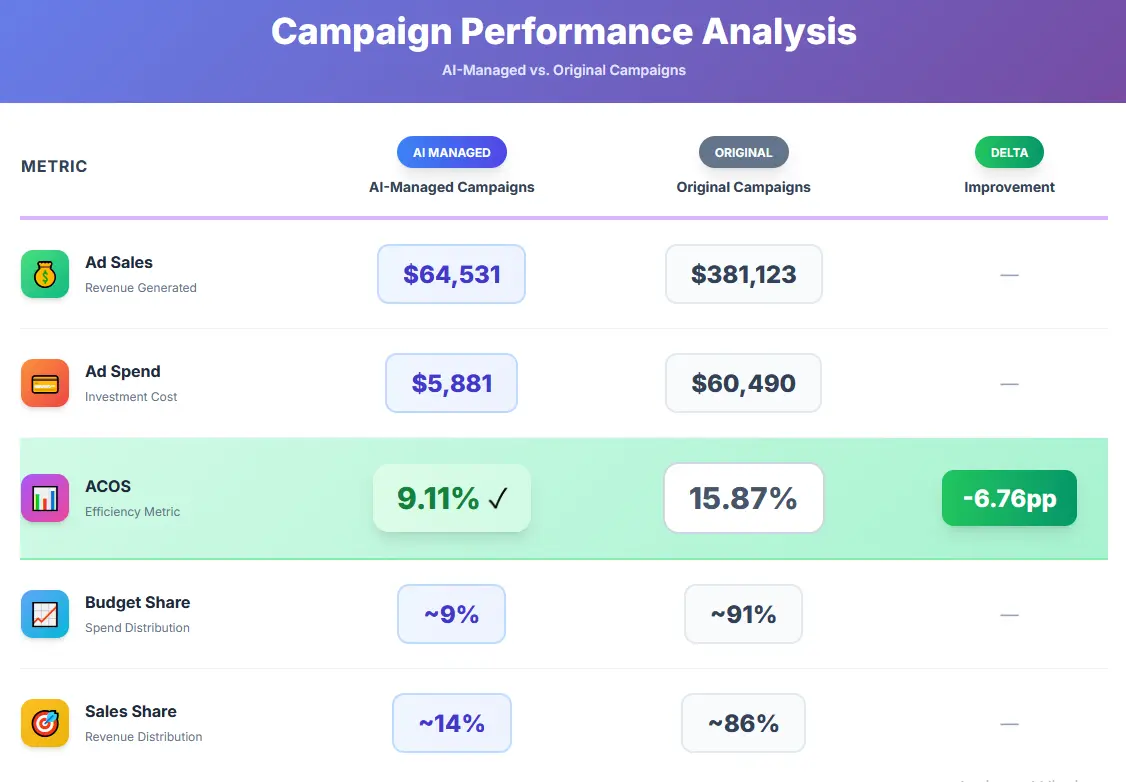

- Extracted 5.6+ Points of Pure Margin: AI campaigns averaged 9.11% ACOS, systematically squeezing out 5.6 percentage points of extra profit from the expert-level baseline.

- Reduced TACOS from 9.76% → 3.69%: AI drove organic sales and increased the share of high-margin, pure-profit orders.

- Became the Account's Profit Hedge: During market volatility, AI held 13.23% ACOS, while manual campaigns spiked to 21.29%, turning from optimizer into a critical risk-mitigation system.

- Proved Autonomous Recovery: After a supply shock, AI recovered to 4.24% ACOS within one month.

Bottom Line for Sellers: DeepBI delivers massive margin gains, stability during volatility, and fast, autonomous recovery, turning even top-performing accounts into self-optimizing profit engines.

Company Background

The Challenge of "Optimizing the Optimized"

This was not about fixing poor performance. In April 2025, the seller's advertising performance was already strong:

.png)

Image from Offical platform "DeepBI"

The client operated in the competitive, high-ticket 3C electronics sector. Before using DeepBI, their account was already a healthy 'master-level account' featuring:

- A mature advertising structure

- An ACOS already optimized to 14.72%

The Seller's Objectives

With the account already at an expert level, the client gave DeepBI two specific tasks:

- Observe whether AI could match or even surpass the original ACOS without disrupting the existing advertising framework.

- Verify AI's stability and anti-risk capability in high-volatility environments.

The trial would be a true test: could AI find profit margins that experienced human operators had already squeezed dry?

The Implementation Approach

In order to test performance, DeepBI was implemented through a controlled parallel-run approach.

A small, predefined portion of the total advertising budget—typically 8–10%—was allocated to AI-managed campaigns, which ran at the same time as the seller's existing campaigns.

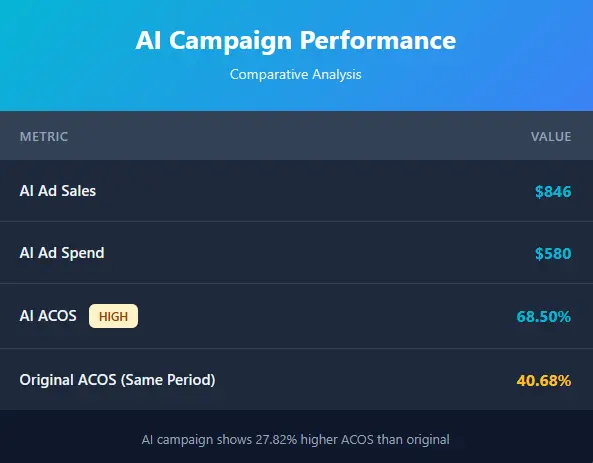

Phase 1: May 2025 — Rapid Learning Curve

Official DeepBI Implementation: May 19, 2025

.png)

Image from Offical platform "DeepBI"

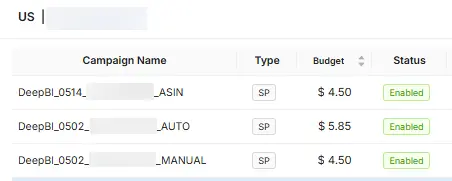

Week 1 (May 19-25): The Learning Phase

This is a typical cold start: With insufficient data samples and the AI still in its exploration phase, a higher ACOS is a normal phenomenon.

It's like training a new employee. They need to become familiar with your product, your target audience, and the competitive environment before they can accurately judge where to place ads, how to bid, and when to scale spend.

The Amazon advertising system is essentially a 'data feedback loop,' and the AI requires time to:

- Identify high-potential audiences for exposure

- Test different bidding and matching strategies

- Verify the positive feedback between conversion rates and campaign scale

The key is: DeepBI's trial-and-error cost is extremely low!

- Minimum campaign budgets as low as $3/day

- The system monitors ACOS, integrating comprehensive performance trends to guide budget adjustments and maintain target efficiency.

- Budgets are selectively increased when ACOS patterns across short-, mid-, and long-term trends indicate efficient performance.

- Budgets are reduced when inefficiencies appear in ACOS performance trends

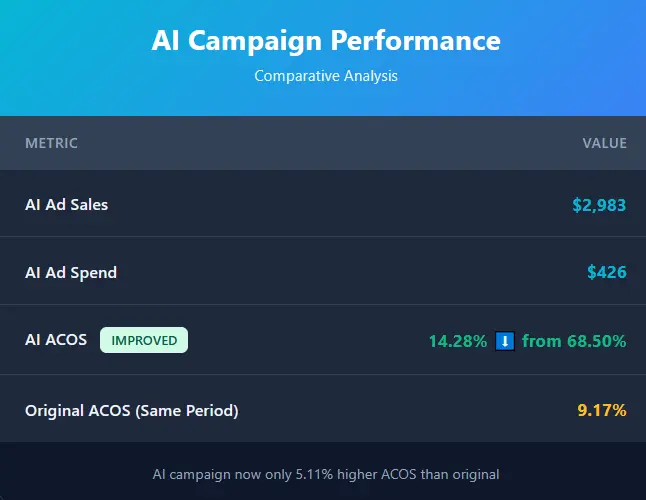

Week 2 (May 26-June 1): Dramatic Convergence

In just one week, the AI rapidly compressed its ACOS from 68.50% during the cold start down to 14.28%, entering the performance range of the client's originally high-quality account. AI ACOS in the second week was already very close to the manual level, and it exhibited smaller fluctuations and greater stability.

May Overall Results:

- AI ACOS: 26.27% (inflated by Week 1 learning)

- Original ACOS: 13.86%

Phase 2: June-July 2025 — AI Takes the Lead

June 2025

.png)

Image from Offical platform "DeepBI"

Breakthrough: Even within the client's mature advertising system, which had already suppressed the overall ACOS to an industry-leading level of 12.6%, DeepBI still achieved nearly a 2-percentage-point further optimization.

How DeepBI's AI Systematically Lowers ACOS

DeepBI lowers ACOS by forcing every ad dollar through a profit filter before it's ever scaled.

- Smart Discovery (Finds What Can Actually Convert)

The system explores keywords, competitor ASINs, and placements broadly—but with guardrails. It looks for traffic that actually generates orders, not clicks, creating a pool of proven opportunities without overspending upfront. - Automatic Waste Removal (Stops Losses Early)

Low-intent and irrelevant traffic is suppressed or blocked before it can drain budget. Anything that fails to show real buying behavior never gets meaningful spend—protecting ACOS at the top of the funnel. - Precision Scaling (Only Profitable Traffic Gets Budget)

Only keywords and ASINs with consistent conversion history are scaled. Bids and placements adjust continuously, and if efficiency drops, spend is automatically pulled back. Budget constantly flows to what's working right now.

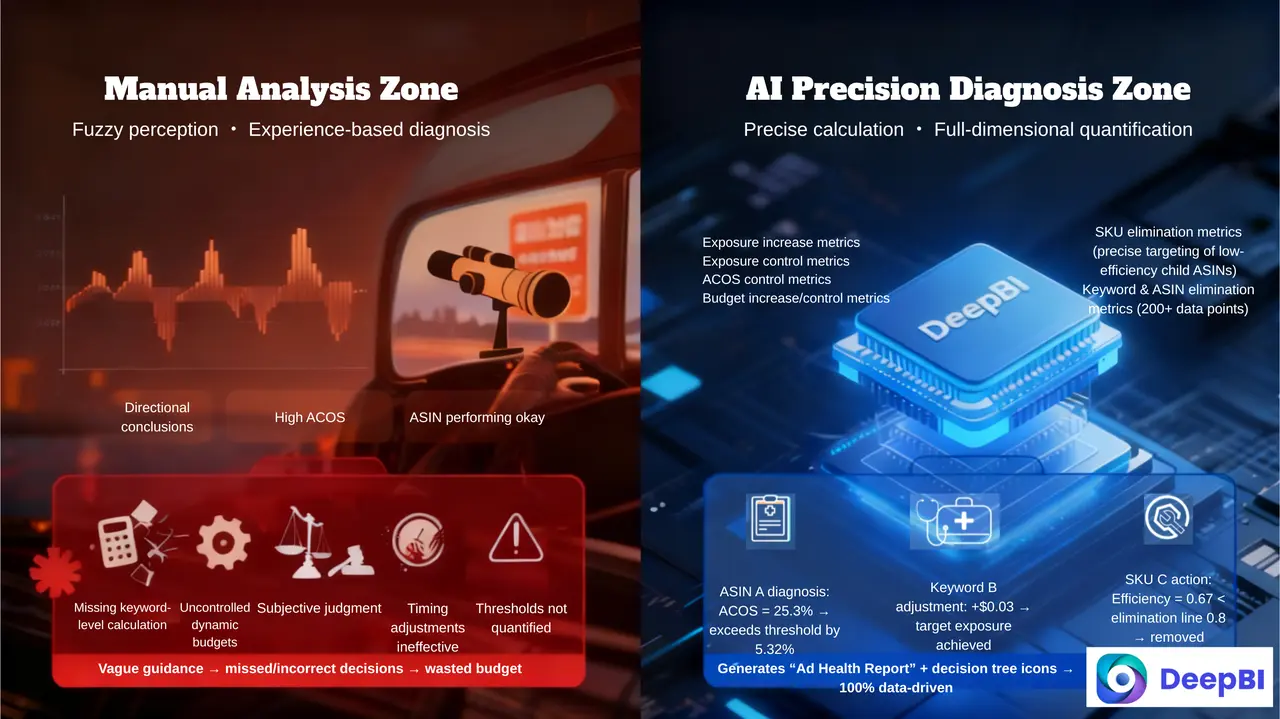

How AI Makes This Possible

This process works because DeepBI continuously calculates and controls performance at a precise level. Every keyword and ASIN is measured continuously, ensuring every decision is data-driven and precise.

Core Capabilities:

DeepBI runs independent calculations on every keyword and ASIN with two-decimal accuracy, covering all major performance metrics, including:

- Metrics to increase or limit visibility

- ACOS control metrics

- Budget increase and budget control metrics

- Keyword and ASIN identification and elimination metrics

- SKU elimination metrics (precise identification of low-performing child ASINs)

- …and 200–300 other related metrics

Why DeepBI Can Lower ACOS Better

Lowering ACOS consistently requires real-time data processing, precise optimization, and large-scale management, which DeepBI AI is designed to handle.

- Data Processing: Humans cannot calculate performance metrics for every keyword and ASIN simultaneously. DeepBI evaluates 200-300 metrics per traffic unit, generating precise insights that guide decisions.

- Strategy Execution: Humans cannot compute optimal bid or budget adjustments for thousands of targets daily. DeepBI determines exact changes for each target daily, based on its proprietary models.

- Systematic Optimization: DeepBI operates at a scale humans simply can't match, tracking 200–300 metrics across 58+ interconnected strategies simultaneously. Every decision is guided by these constraints, continuously driving maximum efficiency and consistent results.

Summary: The combination of large-scale computation, precise parameter adjustment, real-time adaptation, and continuous optimization enables DeepBI to lower ACOS consistently—capabilities beyond what human management can execute at the same scale and speed.

Result: The result is not just lower ACOS, but structurally lower risk, faster learning, and more predictable profitability as the account scales.

July 2025: The Volatility Test

Market conditions deteriorated significantly in July:

- The overall Amazon market has become much more intense.

- Bidding pressure in ads has gone up a lot.

- Traffic is more volatile, with bigger ups and downs.

.png)

Image from Offical platform "DeepBI"

Critical Discovery: While Original campaigns "lost control" (ACOS jumping from ~12% to 21%), AI held steady at 13.23%.

How DeepBI Handles Market Volatility:

DeepBI's AI continuously monitors thousands of traffic units—keywords and ASINs—using 200–300 performance metrics per unit daily. This level of analysis enables data-driven precise responses to changing market conditions.

When a traffic unit underperforms or breaches dynamic efficiency thresholds, spend is immediately reduced or paused, while budget is simultaneously redirected toward newly identified high-potential opportunities. At the same time, the system actively scans competitors to uncover undervalued or vulnerable targets.

This continuous, adaptive approach, guided by the 58+ strategy network and 200-300 performance metrics, prevents ACOS spikes that static or rule-based systems often experience. Instead of reacting slowly, DeepBI treats market volatility as an opportunity for strategic recalibration, ensuring ad spend consistently flows to traffic that converts efficiently and drives long-term organic growth.

Strategic Evolution:

During this month, AI's role expanded beyond simply amplifying profits. In a highly volatile period, DeepBI helped absorb a meaningful portion of the downside risk—preventing performance volatility from cascading across the entire account.

This stabilizing effect became the key reason the AI earned more budget, took on greater sales responsibility, and ultimately contributed to overall business growth.

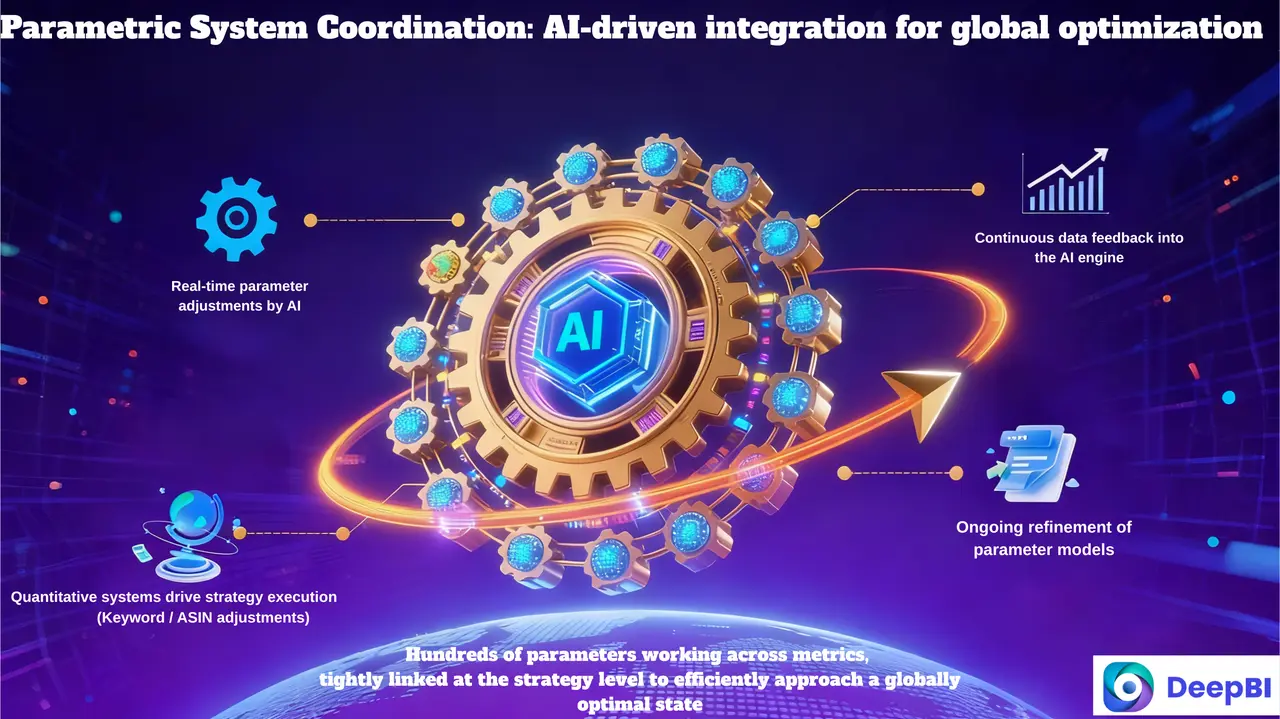

How DeepBI's AI System Actually Works

While the results speak for themselves, understanding how DeepBI achieves them is key to appreciating why it outperforms even expert human management. DeepBI operates on a transparent strategic framework powered by a dynamic quantitative model.

The Five-Layer Funnel: The Strategic Architecture

.png)

Unlike single-rule optimizers, DeepBI manages campaigns through a hierarchical funnel:

Layer 1: Exploration

- Method: Uses Automatic Ads and ASIN Targeting Ads with strict performance guardrails.

- Action: Explores keywords and competitor ASINs broadly, to capture the traffic pool and uncover the high-potential search terms that generate orders.

- Output: Creates a focused pool of proven "Order-Generating" opportunities without wasting budget.

Layer 2: Initial Screening

- Input: Receives Broad Match keywords, Phrase Match keywords, and Expanded Targeting ASINs from Layer 1.

- Action: Suppresses low-intent traffic before it can drain the budget. Any keyword or ASIN showing poor buying behavior is prevented from receiving meaningful spend.

- Function: Protects ACOS at the top of the funnel by filtering out inefficiency.

Layer 3: Precision Layer

- Input: Receives the filtered, higher-potential traffic, Exact Match keywords and Exact Targeting ASINs from previous layers.

- Action: Ensures only the top 10-20% of consistently high-converting keywords and ASINs graduate for major investment. The remaining assets are maintained with minimal exposure to capture ultra-low-cost "opportunistic traffic" (e.g., high-ROI long-tail keywords).

- Function: Acts as a dynamic gatekeeper. Assets that prove performance are instantly flagged for promotion, while underperformers are contained.

Layer 4: Scaling Layer

- Input: Receives the elite, high-converting traffic confirmed by Layer 3.

- Action: Applies AI-powered dynamic bid adjustments and budget prioritization to aggressively scale this traffic.

- Logic: Performance is continuously monitored. Traffic that maintains efficiency is scaled further, while underperforming traffic is dynamically demoted to Layer 3 for re-evaluation.

Layer 5: Natural Traffic Layer

- Core Product Logic: This layer builds upon the high-conversion "keyword vault" identified and scaled in the previous layers.

- Action: Creates dedicated campaigns for these top performers, using AI-driven dynamic bid adjustments with position-based premium bids to secure "Top of Search" placements.

- Mechanism & Outcome: Achieving and sustaining these prominent placements triggers Amazon's algorithmic rewards, boosting the listing's natural search ranking. This drives organic traffic so that organic orders can account for more than 60% of total sales, with every 1 paid order generating 3 or more organic orders over time. At the same time, CTR and CVR reach new highs, far exceeding industry averages, turning paid success into sustained, compounding organic growth and naturally lowering TACOS.

Constraint-Based Optimization

DeepBI's real power lies in how all 58+ strategies interact within a constrained optimization framework. Each strategy doesn't operate in isolation. Every decision must satisfy multiple simultaneous conditions, including:

- Achieving target ACOS across the entire portfolio

- Staying within daily budget limits

- Avoiding keyword cannibalization

- Responding dynamically to competitive changes

- Accounting for seasonal trends

This creates a multi-objective optimization problem with specific constraints—something human managers cannot solve manually.

To make these decisions accurately, DeepBI references recent performance trends—1-day, 3-day, and 7-day ACOS data—so short-term fluctuations don't mislead the system. It also integrates key signals, including:

- Conversion rates

- Keyword and ASIN purchase cycles

- User behavior paths

…and applies critical operational constraints across every strategy, such as:

- Inventory levels

- Exposure controls

- Budget constraints

- Keyword and ASIN prioritization or elimination signals

The Results in Action

When you see ACOS drop from 68% to 14% in just one week, what you're witnessing is DeepBI moving rapidly through the learning phases.

The system's impact becomes even clearer when we look at the timeline of performance:

- May – Fast Learning Period: DeepBI completed rapid learning within two weeks.

- June – Healthy Optimization: ACOS stabilized at a profitable level, with traffic being allocated efficiently.

- July – Takes Lead: Maintain ACOS below the original campaign.

- August–October – Sustained Outperformance: ACOS consistently beat original campaigns.

This framework explains how DeepBI handled the stockout crisis (Nov), and how autonomous recovery (Dec) restored top-performing campaigns without manual intervention.

By linking AI-driven funnel learning with constraint-based, cross-validated decision-making, DeepBI turns complex Amazon ad management into predictable, systematic, and profitable growth.

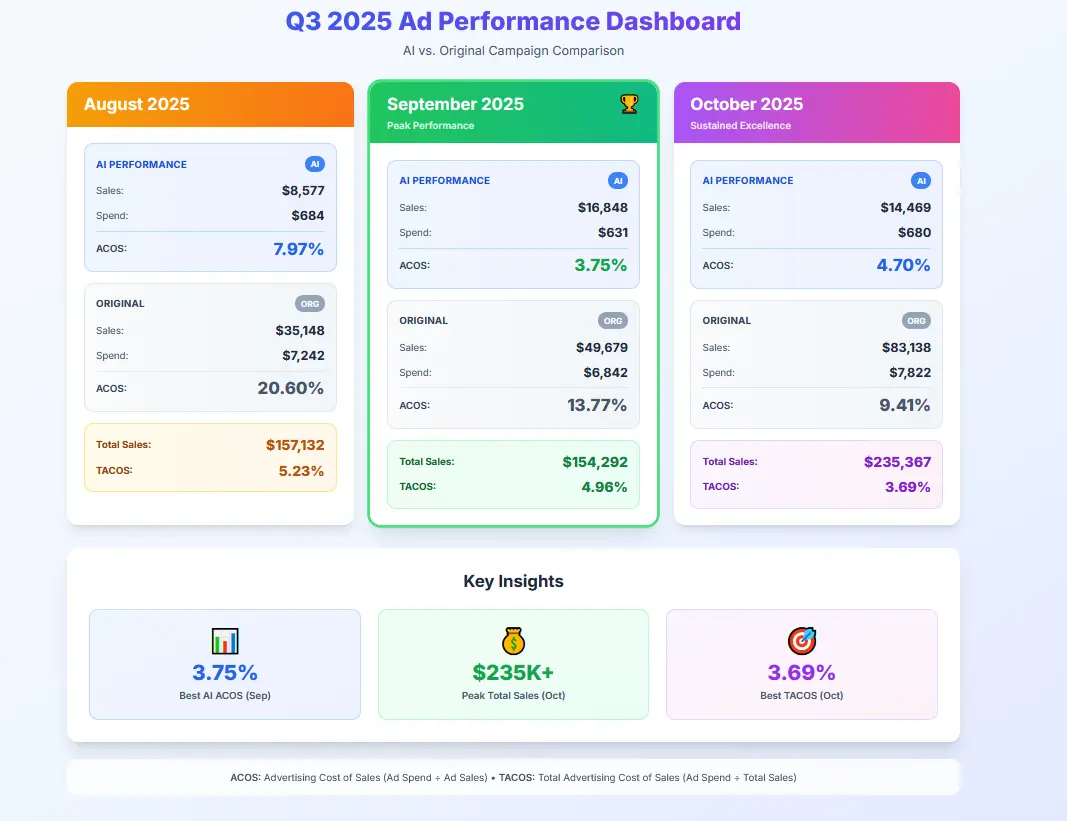

Phase 3: Aug-Oct 2025 — Extreme Efficiency Zone

With its budget deliberately constrained to a minor portion of the total spend, DeepBI's performance answered a critical question: Is its value based on spending more, or spending smarter?

The results demonstrated extreme capital efficiency. Despite the limited budget, AI-managed campaigns consistently achieved significantly lower ACOS than the original campaigns controlling the vast majority of the budget.

.png)

Image from Offical platform "DeepBI"

ACOS Advantage:

AI demonstrated sustained ACOS improvement and consistently outperformed the original campaigns in efficiency across all three months.

ROI Advantage:

For every dollar spent on advertising, DeepBI delivered ROI far beyond what could be sustained through manual efforts over the long term.

Over these three months, DeepBI used its efficient strategy system to maximize impact with limited resources—raising the client's overall "profit efficiency" to a higher level.

The "Organic Growth Engine"

What's even more notable is that this improvement in overall business efficiency (TACOS) was achieved with a relatively limited AI budget. Rather than relying on increased ad spend, the gains came from how effectively the system leveraged organic traffic.

Behind this result is DeepBI's Organic Growth Engine—a strategy focused not on spending more, but on using budget more intelligently to trigger Amazon's organic ranking rewards.

How It Works:

This strategy is built on a pre-validated, high-converting keyword set. This ensures the budget is directed solely toward traffic with demonstrated purchase intent.

Even with a constrained budget, AI then concentrates spend on a small group of top-performing keywords, dynamically adjusting bids to consistently hold premium top-of-search placements. The goal is not volume for its own sake, but to send strong, consistent performance signals to Amazon's algorithm.

As organic rankings improve, a growing share of orders comes from unpaid traffic. Over time, this shifts the order mix toward organic sales—reaching ratios of 1 ad-driven order to 3 organic orders or better, ultimately making organic sales account for more than 60% of total sales—systematically driving TACOS down.

Result: TACOS dropped from 5.23% to 3.69% — the hallmark of a healthy, AI-assisted flywheel.

Phase 4: Nov-Dec 2025 — Crisis Response & Recovery

November 2025: The Stock-Out Test

Core products primarily promoted by DeepBI experienced stockouts, and the replenishment cycle was further disrupted, causing this month's advertising performance to differ sharply from previous months.

While this broke the earlier growth rhythm, it highlighted the fundamental differences between the two advertising management approaches when facing challenges.

.png)

Image from Offical platform "DeepBI"

What Actually Happened:

❌ Surface Reading: "AI tanked during stockout"

✅ Strategic Reality: AI executed a deliberate defense strategy

AI's Crisis Logic:

- Recognized the stockout situation and implemented a strategic shift.

- Withdrew budget from now-futile core keyword campaigns

- Reallocated remaining budget to protect higher-value, long-term assets, including:

- Minimal baseline bids to protect search ranking, listing authority, and market share

- Brand defense keywords (prevent competitors from bidding on your brand terms)

- Related products still in stock

Why spend anything during stockout?

Going completely dark would have caused:

- Keyword ranking collapse (months to recover)

- Competitor occupation of branded search terms

- Loss of hard-won organic momentum

AI spent $676 to protect long-term assets estimated worth thousands in future recovery costs.

Original Campaigns: Continued operating on legacy settings, inefficiently spend $10,044 with no strategic adjustment.

Strategic Pivot-Adaptive Automation:

November's data demonstrated that DeepBI can dynamically adjust its primary objectives and budget strategy in response to real-time business conditions, such as in-stock or out-of-stock situations.

This crisis response is possible because the AI recognizes when core business constraints—such as a product being out of stock—have changed. It automatically reweights its strategies, temporarily deprioritizing profit maximization in favor of asset protection—demonstrating true adaptive automation rather than rigid rule-following.

Under normal conditions, it functions as a growth engine focused on maximizing ROI. During a crisis, it can instantly switch roles to become an asset guardian, shifting its core KPI from lowest ACOS to minimizing total loss—considering both immediate cash expenditure and the hidden risk of future asset depreciation.

.png)

Image from Offical platform "DeepBI"

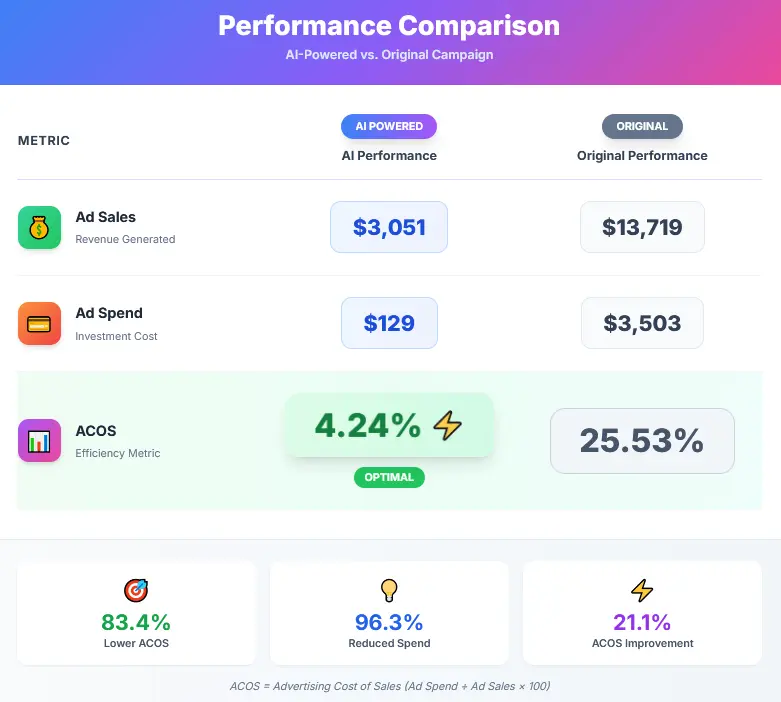

December 2025: Immediate Autonomous Recovery

When November's stockout shock ended and supply normalized, DeepBI automatically recalibrated campaigns for efficient results—proving built-in resilience that protects your profits.

.png)

Image from Offical platform "DeepBI"

The Strategic Divide:

- AI's Response: The system autonomously recalibrated in the same cycle, restoring its advertising strategy to the historical 'extreme profit' benchmark (≤5% ACOS) it had perfected in August-October pre-crisis months. It left no strategic inefficiencies from the disruption.

- Original Campaigns' State: Remained in a disrupted state with elevated ACOS (~25%), requiring manual diagnosis and intervention to rectify.

This shows that DeepBI doesn't just fine-tune campaigns during smooth periods—it quickly recognizes market changes, discards inefficient patterns from the disruption, and returns to optimal performance. It delivers autonomous recovery across your account, restoring peak efficiency fast.

9-Month Cumulative Results

Overall Performance (May - December 2025)

Key Insights

- Efficiency Multiplier

- Starting baseline (April): 14.72% ACOS

- AI 9-month average: 9.11% ACOS

- Improvement: 38% reduction in cost-to-sales ratio

- Peak Performance Capability

- Best monthly ACOS: 3.75% (September)

- Sustained sub-5% ACOS for 3 consecutive months (Aug-Oct)

- This level of efficiency is virtually unsustainable with traditional management

- Risk-Adjusted Returns

- During high-volatility July: AI maintained 13.23% while original hit 21.29%

- During stockout crisis: AI minimized damage and recovered fastest

- AI acts as portfolio insurance, not just optimizer

- Capital Efficiency With just ~$6K in AI-managed ad spend vs $60K+ in original spend,

- AI drove $64K in sales (ROI: 10.97x)

- Original campaigns: $381K sales (ROI: 6.30x)

- AI delivered 74% higher ROI per dollar spent

- By prioritizing profit, DeepBI raises the overall profit efficiency across the entire account.

- Paired with the AI's precision-targeted advertising, the account's TACOS stays consistently in a healthy 3–6% range.

- In high-ticket 3C categories, where every click is costly, even a 1% drop in ACOS directly translates to real, tangible profit for the client

Key Takeaways for Amazon Sellers

1. AI Isn't Just for "Broken" Accounts

This case proves AI can uncover additional efficiency even in expertly-managed accounts. If you're already at 12-15% ACOS, AI can find 5 to 11 percentage points.

2. The Learning Phase Is Short and Controlled

- Week 1 (mid-May): High ACOS is expected (but budget-capped)

- Week 2 (late May): AI reaches parity with original

- Week 3 onward (June): AI begins outperforming

3. AI's Real Value Shows During Volatility

The July and November performance deltas reveal AI's true competitive advantage:

- Humans react to problems

- AI anticipates and auto-corrects

In high-ticket categories where one bad month can devastate margins, this stability is priceless.

4. Budget Constraints Don't Limit AI Effectiveness

With just 8-10% of total ad budget, DeepBI delivered disproportionate returns. This means:

- You can test AI on a small slice of budget

- Scale up only after proven results

- Keep original campaigns running in parallel

5. The Organic Multiplier Effect

- AI identifies and scales top-converting "hidden gem" keywords.

- Secures Top of Search placements, boosting Amazon algorithm signals.

- Organic traffic grows (often 1:3 ad-to-organic orders), reducing TACOS and creating a self-reinforcing growth loop.

6. Why DeepBI Outperforms Traditional Management

DeepBI operates on a Five-Layer Funnel Protocol with 58+ integrated strategies, not just isolated bid rules.

- Quantitative Precision: Makes decisions based on 200-300 metrics analyzed across multiple timeframes (short, mid, and long term) avoiding false signals from daily volatility.

- Adaptive Automation: Recognizes changes in business conditions (like stockouts) and re-optimizes objectives accordingly—from profit maximization to asset protection.

- Continuous Optimization: Runs 24/7 constrained optimization across your entire account portfolio, finding micro-inefficiencies difficult to identify during periodic human review.

Who Should Consider DeepBI?

✅ Ideal Fit:

- High-ticket products (electronics, home goods, premium categories)

- ACOS-sensitive businesses (thin margins, competitive niches)

- Sellers who've "hit a wall" with traditional optimization

- Brands experiencing frequent market volatility

While these profiles benefit most, DeepBI's core capability—systematically lowering ACOS and TACOS to build a profitable growth flywheel—delivers value across a wide range of categories and price points.

Conclusion

This case study proves DeepBI delivers extreme profit optimization for successful sellers too. By taking an already-elite Amazon advertising operation and squeezing out an additional 5-6 percentage points of ACOS efficiency, DeepBI proved that:

- AI outperforms expert human management — not by replacing strategy, but by executing it with superhuman precision

- The "optimized ceiling" is higher than we think — even mature accounts have hidden efficiency gains

- AI's defensive value often exceeds its offensive value — stability during crises protects long-term profits

For Amazon sellers in any category, it's not 'Can we afford AI?'—it's 'Can we afford NOT to?'

About DeepBI

DeepBI: Award-winning, open-source AI built specifically for Amazon sellers.

Powered by machine learning trained on billions of ad auctions, it autonomously optimizes bids, budgets, and campaigns—maximizing profit while cutting wasted spend.

Ready to test AI on your Amazon advertising?

Contact DeepBI for a free account audit

Email: support@deepbi.com

Case study data verified from client's Amazon Seller Central and DeepBI platform analytics. Client identity anonymized per agreement. Results documented May-December 2025.